The world of commodity supply chains is undergoing a rapid transformation. For decades, as a commodity producer, you have been a price-taker, operating with limited relationships, little data ownership, and minimal ability to differentiate your product. But the rules are changing, first-mile data (particularly environmental metrics) increasingly defines how commodities are bought and sold. This isn't just about compliance; it's an unprecedented opportunity for producers to create and capture value, to stand out in a competitive marketplace.

The world is now actively paying for environmental outcomes, and your data is the key to unlocking this value. Here is why you should invest in owning and leveraging your specific emissions data to enhance your business:

Differentiate Your Product and Command Better Pricing

Your product is no longer just a commodity. With supplier-specific emissions factors and risk scores, you gain the ability to distinguish your position in a trusted supply chain. You can price not just the physical product, but also the environmental performance associated with its production. This means you can differentiate yourself in markets where it was traditionally difficult to do so.

For example, ESF Seafood, a shrimp processor is able to solidify their positioning as a premium supplier across their buyers, due to, among other things, their product carbon footprint being up to 62% lower than comparable producers in competing origins. This signals to their buyers their commitment to sustainability and being a long-term supplier of choice that is the most resilient in the face of increasing number of supply shocks and volatility across these supply chains.

Unlock New Revenue Streams

Environmental data on targeted interventions directly translate into new income for your operations. Owning your data can help you quantify and monetize carbon removals from your supply base. Golden Agri-Resources and Lujeri Tea Estates are two producers already leveraging Epoch to quantify carbon removals for monetization.

The recent SBTi Net Zero Standard revisions are a game-changer, recognizing indirect mitigation approaches like book-and-claim commodity certificates where direct traceability isn't possible. This means a large retailer or CPG company can purchase Environmental Attribute Certificates, (Carbon Removals), from you even if you're not in their direct supply chain, significantly expanding your market of potential buyers. Lujeri Tea Estates, for instance, identified over 500,000 tCO2e in carbon reductions across their supply base that can be monetized with the right data infrastructure.

Attract Sustainable Financing and Reduce Costs

Your environmental data also opens doors to financial benefits beyond direct sales. The market for sustainable finance has grown 5x in the last five years; most financial institutions are increasingly tying their lending activities to environmental performance of their clients with incentive structures to improve those metrics. Sustainability-linked loans and bonds, green bonds and other forms of lending can not only reduce your cost of capital, but open up relationships with a greater pool of lenders.

The financial services industry, including banks and insurance companies, are under increasing pressure to expand their sustainable finance portfolio and closely monitor the climate and nature related risks of their clients. Owning data on your environmental metrics positions you as a lower risk counterparty than your peers, allowing you to tap into the growing market of sustainable finance, making a meaningful impact to your balance sheet.

Strengthen Buyer Relationships and Enhance Market Access

Compliance requirements are tightening globally, with regulations like the EU Deforestation Regulation (EUDR), the Corporate Sustainability Reporting Directive (CSRD), Lacey Act, and United Kingdom Timber Regulation (UKTR) driving the industry towards sustainable sourcing practices. Buyers are setting net-zero targets and need to report on their Scope 3 emissions, making your data a critical tool for your partners and customers. By providing data that helps your buyers and retailers meet their net-zero goals and comply with regulations, you foster deeper long-term relationships.

Likewise, companies are now required to progressively source with a level of emissions performance compatible with reaching net-zero emissions. This means that having demonstrable emissions tracking and a path to net-zero will directly impact your ability to access more accounts and grow your market share.

Build Resilience Against Climate Shocks

Climate change is already rapidly increasing costs. Global yearly economic damage from weather events is up 7 times since the 1990s, with the agriculture sector bearing a whopping 63% of that total economic cost (FAO). Many supply bases, specifically in the tropical soft commodity sector like coffee, cocoa, and rubber, have faced repeated supply shocks due to climate events.

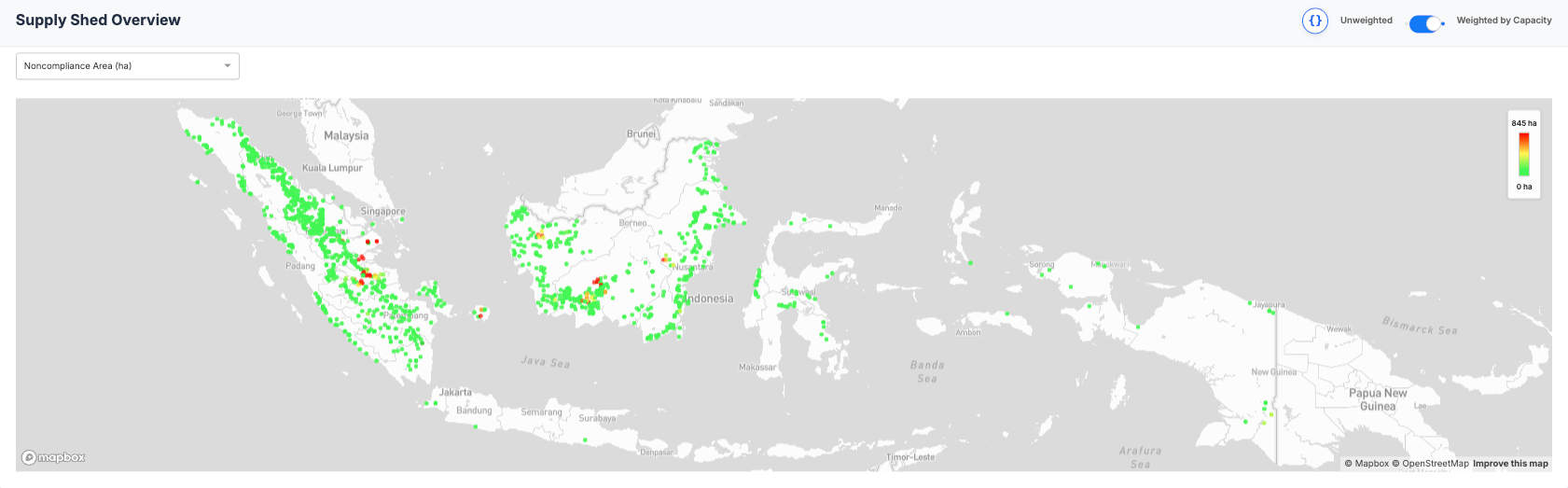

Despite the growing vulnerability posed by climate change, your data, especially ecological data from your supply shed, can scientifically prove the climate resilience of your operations. Insights like improved forest cover that can significantly reduce landslide risk and enhance resistance to damage from heat stress, or adequate water yield which protect against flash floods and droughts, and substantial biodiversity that can improve resilience to diseases and lower impact from pests, are all identifiable data points that prove your yield stability to the market.

By combining weather and climate risk scores along with your supply base's resilience scores, you get a more accurate assessment of your operations' ability to withstand climate and weather hazards. This allows for actionable insights to prioritize supply chain investments that improve resilience in the face of climate impacts and demonstrate your adaptive capacity to partners.

The Future is Data-Driven

Supplier-specific data plays a critical role in decarbonization strategies for companies accounting for 92% of global GDP, and this role is validated by the latest revisions to the SBTi Corporate Net Zero Standard. This undeniable trend means that monitoring and quantifying your environmental impact will make you more resilient and attractive to buyers, while simultaneously lowering your cost of capital, reducing insurance costs, and bolstering your top line through new revenue streams.

It is clear that in this evolving landscape, your data isn't just about compliance anymore; it's about differentiation, market access, and supply base stability. Your data is quickly becoming one of your most valuable assets.

Epoch Empowers You to Own Your Data

Epoch's APIs process your data and provide insights to you and to whomever you choose to share it with. Our platform offers comprehensive monitoring of all carbon emissions from your operations using open and transparent methodologies, and provides the technical capabilities to help you operationalize decarbonization efforts and package interventions.

Connect with Epoch today and discover how we can help you add value to your operations.