Earlier this week, SBTi released an "initial consultation" document with proposed revisions to the Corporate Net Zero Standard. This is an important document because SBTi net-zero pledges cover 92% of global GDP with virtually all major corporations around the world referencing this standard to devise their decarbonization strategy and report on their progress.

More importantly, this Scope 3 portions of this document impact how corporates manage their supply chains and interact with their suppliers. This week's release contains several updates that are quite positive for suppliers, especially those that are already on their path to decarbonize (and becoming more resilient).

Key Updates

"The standard recognises the use of indirect mitigation approaches (e.g. book-and-claim commodity certificates) where direct traceability is not possible or persistent barriers prevent mitigation at the source."

What this means is that a large retailer or CPG company with a specific commodity exposure (e.g. palm oil) can purchase EACs (Environmental Attribute Certificates - Carbon Removals) from a supplier of that same commodity even though that supplier may not be in their direct supply chain. This is a welcome change for us and our customers for whom we are producing the EACs because their market of EAC buyers just got a lot bigger.

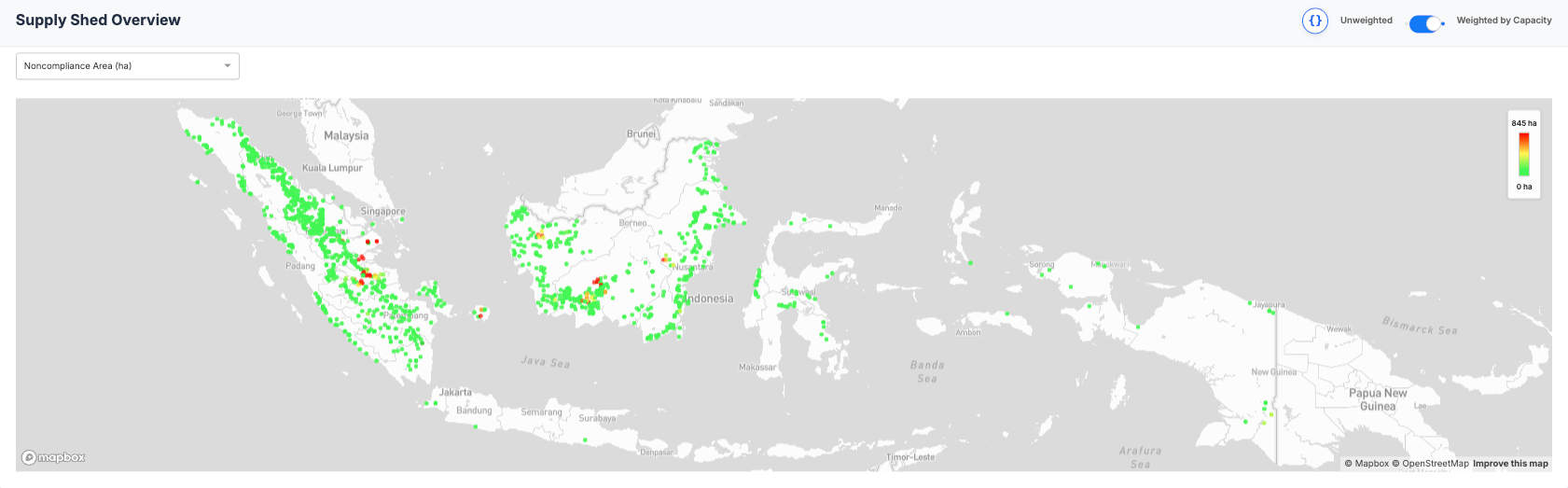

"[The standard] acknowledges challenges related to traceability and data quality and allows for interventions at the activity-pool level (e.g. supply sheds) when direct traceability to specific emission sources is not feasible."

Because a lot of the interventions we see from producers are to improve resilience, they happen at the supply shed level, not necessarily within the commodity growing plots. So the ability to also incorporate the impact of these interventions as removals broadens the scale of the impact our customers are able to monetize. Moreover, buyers of the removals can also include other supply chains linked to the same supply shed (e.g., rubber and cocoa), further growing the market of EAC buyers for our customers.

"In addition to setting targets to address emissions, companies (shall/should) develop sourcing policies in which they commit to progressively source from entities, activities and commodities that have achieved a level of emissions performance compatible with reaching net-zero emissions at the global level."

This is the most significant change as it requires companies to change their sourcing policies to progressively source from suppliers that are tracking their emissions and have a demonstrable pathway to decarbonize. We are already seeing this dynamic play out with some of our customers, who are using our data to get into more accounts and grow their market share. This mandate only blows more wind in their sails. We are undeniably moving from a world of global and regional emissions factors to supplier-specific emissions.

Conclusion

We have differentiated Epoch as the platform built to help producers to monetize their environmental metrics. Several developments over the last several months have only validated the thesis that producers continue to grow what they stand to gain. Monitoring and quantifying the impact of their interventions on their supply base makes them more resilient, more attractive to buyers, and gives them the ability to lower their cost of capital, insurance costs and add to their top line through the sales of carbon removals and EACs.

We currently monitor 2.7M hectares of commodity producing land with the ability to generate over 10M tCO2e (Carbon Removals or EACs). That is a huge opportunity in itself, but at the same time only a small fraction of 6B hectares of productive land that can be monetized.